The U.S. Senate recently took a significant step toward regulating the cryptocurrency industry by advancing a key bipartisan bill, marking a pivotal moment after initial Democratic opposition stalled an earlier vote. The legislation, which seeks to establish a regulatory framework for digital assets, has reignited debates over how cryptocurrencies should be governed, balancing innovation with investor protection.

This development comes amid growing pressure from both the crypto industry and lawmakers to clarify the legal status of digital assets, particularly as other countries race ahead with their own regulatory frameworks. The bill’s progress signals a potential shift in the political landscape surrounding crypto regulation, though hurdles remain before it can become law.

The Failed First Vote and Democratic Concerns

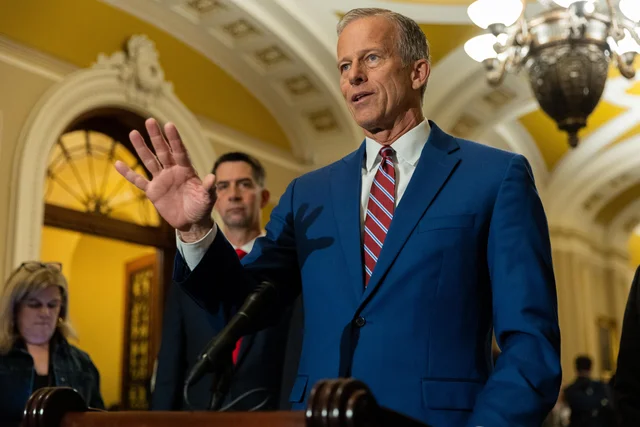

Earlier this year, a similar crypto bill faced strong resistance from Senate Democrats, who raised concerns about consumer protections, financial stability, and the environmental impact of cryptocurrency mining. Key Democratic leaders, including Senator Elizabeth Warren (D-MA), argued that the legislation did not go far enough in addressing fraud, market manipulation, and the risks posed by stablecoins—a type of cryptocurrency pegged to stable assets like the U.S. dollar.

The initial version of the bill was seen by critics as too industry-friendly, potentially allowing crypto firms to operate with minimal oversight. Some Democrats also feared that lax regulations could enable money laundering and other illicit activities, echoing warnings from the Securities and Exchange Commission (SEC) and the Treasury Department.

As a result, the first Senate vote on the bill failed to gain enough Democratic support, leaving the legislation in limbo. However, negotiations continued behind the scenes, with lawmakers working to address concerns while maintaining bipartisan backing.

Key Provisions of the Revised Bill

The revised version of the bill includes several compromises aimed at winning over skeptical Democrats while preserving Republican and industry support. Key provisions include:

-

Clearer Regulatory Jurisdiction – The bill clarifies whether cryptocurrencies should be classified as securities (regulated by the SEC) or commodities (regulated by the CFTC). This distinction has been a major point of contention, with many crypto companies arguing that inconsistent classification stifles innovation.

-

Stablecoin Regulations – Given the risks highlighted by the collapse of TerraUSD in 2022, the bill imposes stricter reserve and transparency requirements for stablecoin issuers.

-

Consumer Protections – The updated legislation includes stronger safeguards against fraud and requires crypto exchanges to adhere to stricter disclosure rules.

-

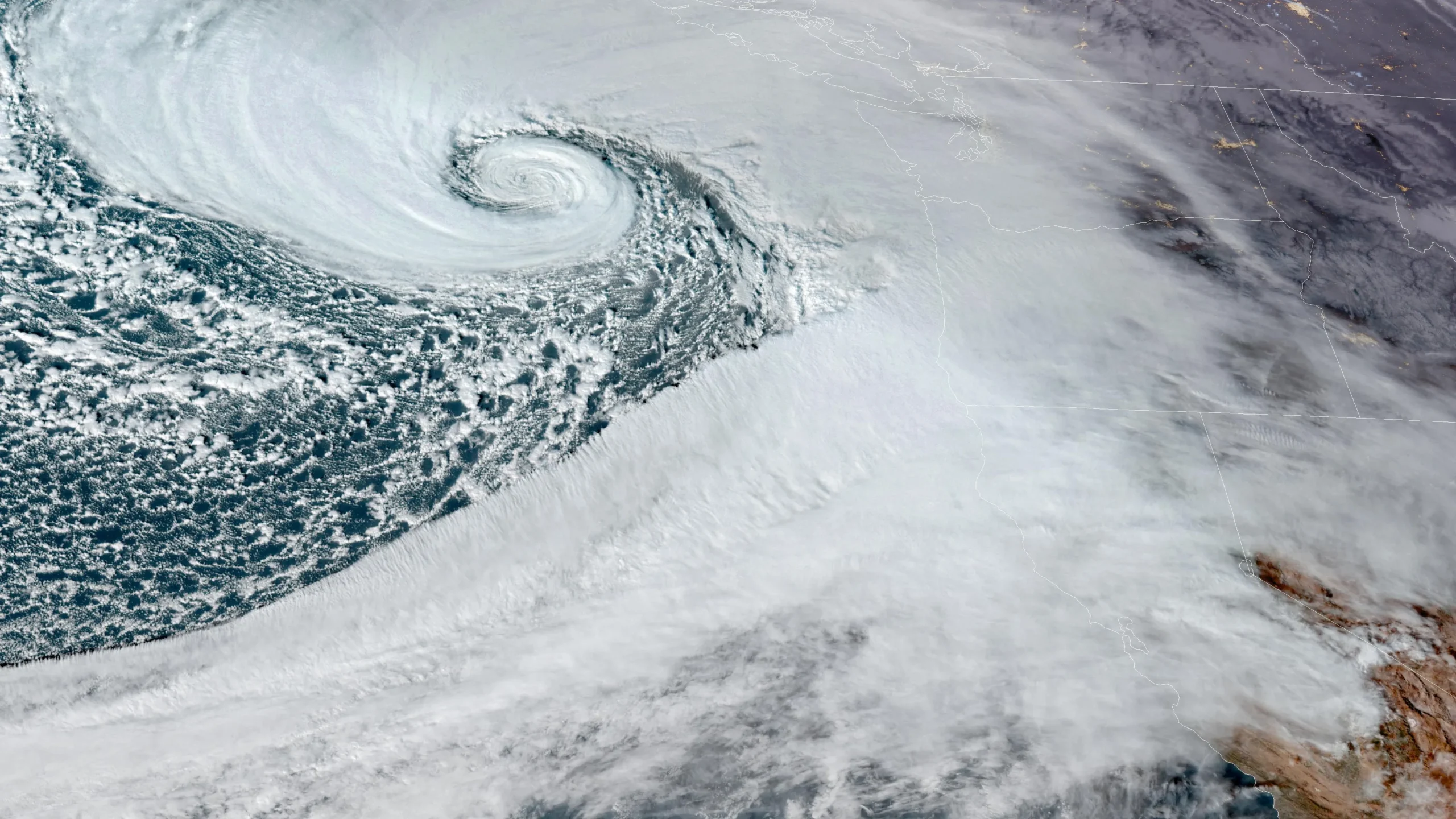

Environmental Standards – To address concerns about the energy-intensive nature of proof-of-work mining (used by Bitcoin), the bill encourages the adoption of more sustainable blockchain technologies.

These adjustments helped secure enough Democratic votes to advance the bill, though some progressive lawmakers remain opposed, arguing that further amendments are needed.

Industry and Market Reactions

The crypto industry has largely welcomed the bill’s progress, viewing it as a step toward regulatory clarity that could encourage further institutional investment. Major players like Coinbase and Andreessen Horowitz have lobbied heavily for such legislation, arguing that clear rules will help the U.S. remain competitive in the global digital asset market.

However, some decentralization advocates worry that excessive regulation could stifle innovation or push crypto development overseas. Meanwhile, traditional financial institutions have expressed mixed reactions, with some banks calling for stricter oversight while others explore ways to integrate cryptocurrencies into their services.

Market reactions have been cautiously optimistic, with Bitcoin and Ethereum seeing modest gains following the Senate’s vote. Analysts suggest that regulatory certainty could reduce volatility and attract more mainstream adoption.

What’s Next for the Crypto Bill?

While the Senate’s approval marks a significant milestone, the bill still faces challenges before becoming law:

-

House Approval – The House of Representatives, which has its own competing crypto bills, must reconcile differences with the Senate version.

-

White House Stance – The Biden administration has expressed concerns about crypto risks, and while it has not outright opposed the bill, it may push for additional amendments.

-

Potential Legal Challenges – Even if passed, the bill could face lawsuits from industry groups or states arguing that it oversteps federal authority.

Conclusion

The Senate’s advancement of the crypto bill represents a breakthrough after months of political gridlock. By addressing Democratic concerns while maintaining industry support, lawmakers have taken a crucial step toward establishing a comprehensive regulatory framework for digital assets.

However, the path forward remains uncertain, with debates likely to continue over how best to balance innovation, consumer protection, and financial stability. As the bill moves through Congress, its final form—and its impact on the crypto ecosystem—will depend on further negotiations and compromises.