The U.S. government is once again approaching a critical financial deadline, with Treasury Secretary Scott Bessent warning that the nation will hit its debt ceiling by August. This looming deadline raises concerns about potential economic disruptions, political gridlock, and the broader implications for global markets.

As lawmakers prepare for another high-stakes debate over raising the borrowing limit, economists and policymakers are urging swift action to avoid a catastrophic default. Here’s what you need to know about the debt ceiling, why it matters, and what could happen if Congress fails to act in time.

What Is the Debt Ceiling?

The debt ceiling is a statutory limit set by Congress on how much the U.S. Treasury can borrow to meet its financial obligations. These obligations include Social Security payments, military salaries, interest on existing debt, and other government expenditures.

Since the U.S. operates on a budget deficit—meaning it spends more than it collects in revenue—it must periodically raise the debt limit to avoid defaulting on its bills. Failure to do so could trigger a financial crisis, shaking confidence in the U.S. dollar and destabilizing global markets.

Why August Is the Critical Deadline

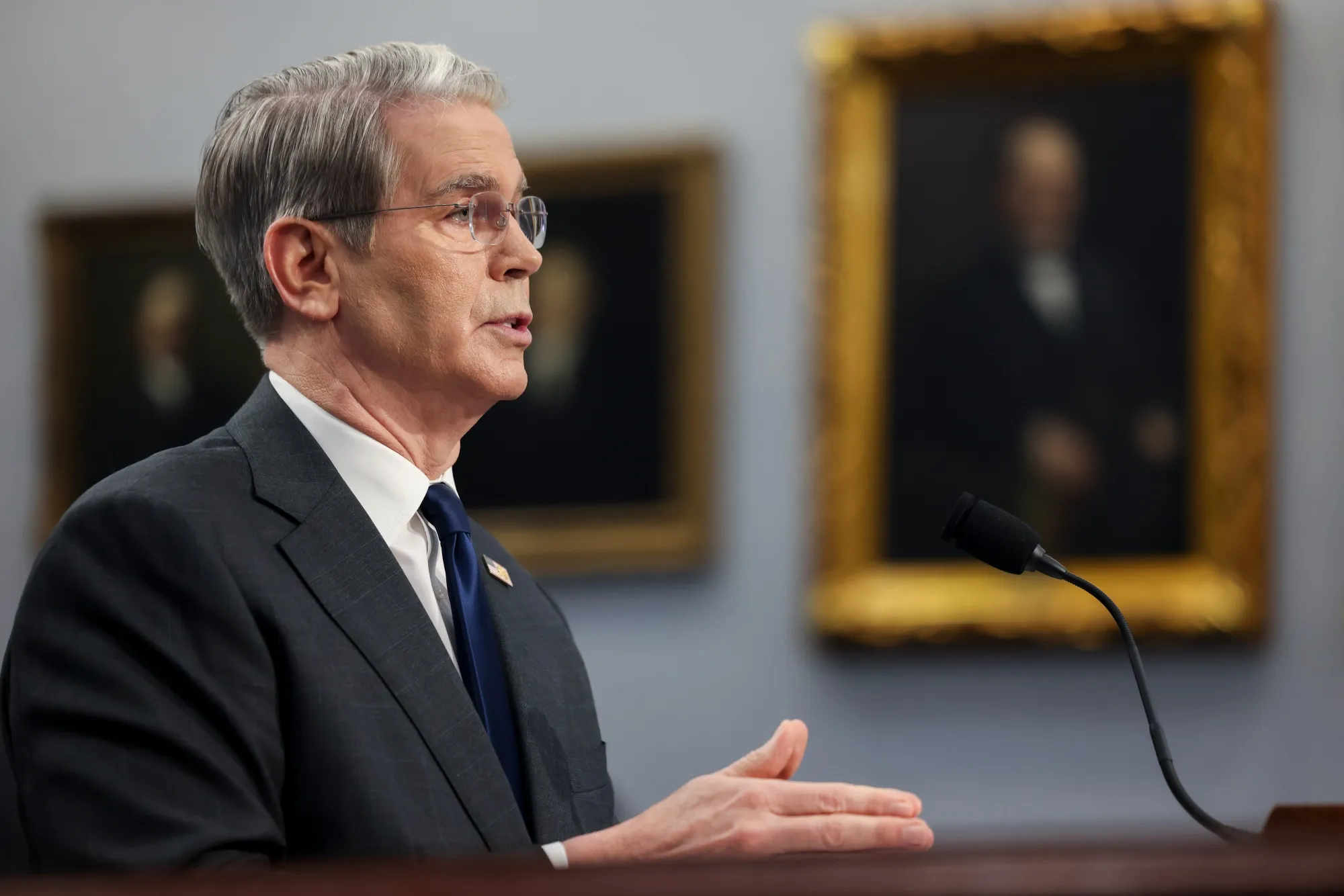

Treasury Secretary Scott Bessent has projected that the U.S. will exhaust its borrowing authority by August, based on current spending trends and tax revenues. The Treasury has already begun employing “extraordinary measures”—accounting maneuvers that temporarily extend the deadline—but these are only short-term solutions.

Historically, Congress has raised or suspended the debt ceiling multiple times, but the process is often fraught with political brinkmanship. With a divided government and heightened partisan tensions, negotiations this year could be particularly contentious.

Potential Consequences of Hitting the Debt Limit

If the U.S. fails to raise the debt ceiling, the consequences could be severe:

1. Government Shutdown or Delayed Payments

The Treasury may be forced to prioritize payments, delaying funds for federal programs, contractors, or even Social Security recipients. A prolonged standoff could lead to a partial government shutdown, disrupting services and hurting economic growth.

2. Risk of Default

A worst-case scenario would involve the U.S. missing payments on its debt obligations. This would mark an unprecedented default, damaging the country’s credit rating and increasing borrowing costs for the government, businesses, and consumers.

3. Market Turmoil and Economic Instability

Financial markets rely on U.S. Treasuries as a safe-haven asset. A default or even the threat of one could trigger stock market declines, higher interest rates, and a loss of investor confidence worldwide.

4. Global Repercussions

The U.S. dollar is the world’s reserve currency, and Treasury bonds are a cornerstone of the global financial system. A debt ceiling crisis could weaken the dollar’s dominance and create instability in international markets.

Political Battle Ahead

The debate over raising the debt ceiling often becomes a proxy war over government spending. Some lawmakers may demand spending cuts or fiscal reforms in exchange for their votes, while others argue that the ceiling should be raised without conditions to avoid economic harm.

In recent years, debt ceiling standoffs have led to last-minute deals, such as the 2011 Budget Control Act and the 2023 Fiscal Responsibility Act. However, each confrontation risks accidental miscalculation, where political delays could push the country too close to the edge.

Possible Solutions

To avert a crisis, Congress has several options:

-

Raise the Debt Ceiling – Congress could vote to increase the borrowing limit, as it has done numerous times in the past.

-

Suspend the Debt Limit – Instead of setting a new ceiling, lawmakers could temporarily suspend it, as seen in recent years.

-

Budget Negotiations – A broader fiscal deal could include spending reforms alongside a debt limit increase.

-

Extraordinary Measures Extended – The Treasury could stretch its emergency tactics further, but this is not a permanent fix.

Conclusion: A Test of Economic and Political Stability

The August deadline serves as a stark reminder of the recurring challenges posed by the debt ceiling. While the U.S. has always managed to avoid default in the past, each close call carries risks for the economy and global financial stability.

Treasury Secretary Scott Bessent’s warning underscores the urgency for Congress to act responsibly. Political posturing must not overshadow the need for a timely resolution—failure to raise the debt ceiling could have dire consequences for millions of Americans and the world at large.

As the deadline approaches, all eyes will be on Washington to see whether lawmakers can once again navigate this fiscal cliff or if the nation will face an avoidable crisis.